Buying a Home is 36% Less Expensive Than Renting Nationwide!

[ad_1]

In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.

The updated numbers…

Buying a Home is 36% Less Expensive Than Renting Nationwide!

[ad_1]

In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.

The updated numbers…

The Top Reasons Why Americans Buy Homes

[ad_1]

Last week, the inaugural “Homebuyer Insights Report” was released by the Bank of America. The report revealed the reasons why consumers purchase homes and what their feelings are regarding homeownership.

Consumer Lending Executive,…

The Top Reasons Why Americans Buy Homes

[ad_1]

Last week, the inaugural “Homebuyer Insights Report” was released by the Bank of America. The report revealed the reasons why consumers purchase homes and what their feelings are regarding homeownership.

Consumer Lending Executive,…

Over Half of Americans Planning on Buying in the Next 5 Years

[ad_1]

According to the BMO Harris Bank Home Buying Report, 52% of Americans say they are likely to buy a home in the next five years. Americans surveyed for the report said that they would be willing to pay an average of $296,000 for a home…

Over Half of Americans Planning on Buying in the Next 5 Years

[ad_1]

According to the BMO Harris Bank Home Buying Report, 52% of Americans say they are likely to buy a home in the next five years. Americans surveyed for the report said that they would be willing to pay an average of $296,000 for a home…

You Can Save for a Down Payment Faster Than You Think

[ad_1]

In a study conducted by Builder.com, researchers determined that nationwide, it would take “nearly eight years” for a first-time buyer to save enough for a down payment on their dream home.

Depending on where you live, median rents,…

You Can Save for a Down Payment Faster Than You Think

[ad_1]

In a study conducted by Builder.com, researchers determined that nationwide, it would take “nearly eight years” for a first-time buyer to save enough for a down payment on their dream home.

Depending on where you live, median rents,…

More & More Singles Are Falling For Their Dream Home [INFOGRAPHIC]

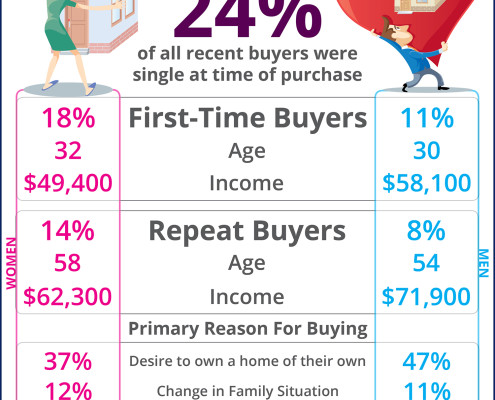

[ad_1] Some Highlights: 24% of all recent home buyers were single at the time of purchase.

47% of single men cite the desire to own a home of their own as the primary reason to buy.

18% of first-time buyers were single women. [ad_2]

Source…

More & More Singles Are Falling For Their Dream Home [INFOGRAPHIC]

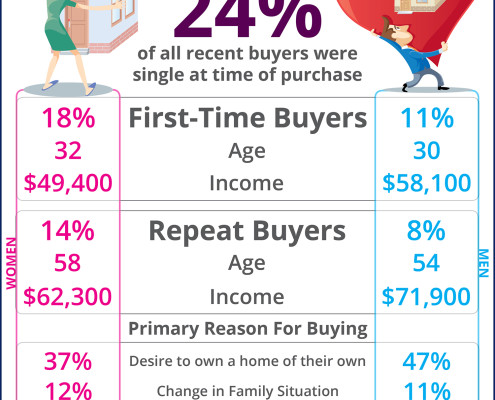

[ad_1] Some Highlights: 24% of all recent home buyers were single at the time of purchase.

47% of single men cite the desire to own a home of their own as the primary reason to buy.

18% of first-time buyers were single women. [ad_2]

Source…

Building Wealth: First Rung on the Ladder is Housing

[ad_1]

How Housing Matters is a joint project of the Urban Land Institute and the MacArthur Foundation. It is “an online resource for the most rigorous research and practical information on how a quality, stable, affordable home in a vibrant…

Building Wealth: First Rung on the Ladder is Housing

[ad_1]

How Housing Matters is a joint project of the Urban Land Institute and the MacArthur Foundation. It is “an online resource for the most rigorous research and practical information on how a quality, stable, affordable home in a vibrant…