69% of Buyers are Wrong About Down Payment Needs

[ad_1] According to a recent survey conducted by Genworth Financial Inc. at the Annual Mortgage Bankers’ Association Secondary Market Conference, 69% of potential first-time buyers still believe a 20% down payment is necessary to buy in…

Your Tax Return: Bring it Home

[ad_1]

This time of year, many people eagerly check their mailboxes looking for their tax return check from the IRS. But, what do most people plan to do with the money? GO Banking Rates recently surveyed Americans and asked the question -…

How Fast Can You Save for a Down Payment?

[ad_1]

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long would it take you to save for…

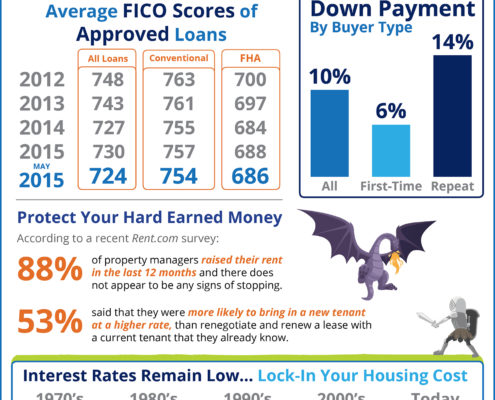

Slaying Home Buying Myths [INFOGRAPHIC]

[ad_1] Some Highlights:Interest rates are still below historic numbers.88% of property managers raised their rent in the last 12 months!The credit score requirements for mortgage approval continue to fall.

[ad_2]

Source link

Home Mortgages: Rates Up, Requirements Easing

[ad_1]

The media has extensively covered the rise in mortgage interest rates since last fall (from 3.42% last September to the current 4.1% according to Freddie Mac). However, a less covered aspect of the mortgage market is that requirements…

Millennials Flock to Low Down Payment Programs

[ad_1]

A recent report released by Down Payment Resource shows that 65% of first-time homebuyers purchased their homes with a down payment of 6% or less in the month of January.The trend continued through all buyers with a mortgage, as 62%…

Again… You Do Not Need 20% Down to Buy NOW!

[ad_1]

A survey by Ipsos found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. There are two major misconceptions that we want to address today.1.…

2 Myths That May Be Holding Back Buyers

[ad_1]

Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.”

Myth #1: “I…

3 Tips for Making Your Dream of Buying a Home Come True [INFOGRAPHIC]

[ad_1]

Some Highlights:Realtor.com recently shared “5 Habits to Start Now If You Hope to Buy a Home in 2017.”Setting up an automatic savings plan that saves a small amount of every check is one of the best ways to save without thinking…

The Dangers of “Tight Mortgage Credit” Headlines

[ad_1]

The availability of mortgage credit is not at the same level that it was during the boom in housing (2005), and that’s good news. However, the constant headlines which talk about “tight credit” are causing some potential home…

Slaying Myths About Home Buying [INFOGRAPHIC]

[ad_1] Some Highlights:Interest Rates are still below historic numbers.88% of property managers raised their rent in the last 12 months!Credit score requirements to be approved for a mortgage continue to fall.

[ad_2]

Source link

You Can Save for a Down Payment Faster Than You Think

[ad_1]

In a study conducted by Builder.com, researchers determined that nationwide, it would take “nearly eight years” for a first-time buyer to save enough for a down payment on their dream home.

Depending on where you live, median rents,…